The financial sector plays a vital role in building an economy and increasing its profits. Money is used to create both local and international economies, with both the private and government sector coming together to offer channels through which this can happen. Thus, financial services are not only a profitable avenue for business men but a must-have for every country. With this need, many financial services have come up over the years with sophisticated systems that allow them to compete to provide needed services using technology.

Unlike the olden days when customers would have to visit a bank or insurance company to get a service, technology has brought banks to the comfort of people’s houses and board rooms. The financial service cannot ignore the role of online and digital marketing. One way to ensure excellent growth and sufficient customer delivery is to have efficient financial services internet marketing.

This article seeks to explain how to boost digital marketing for financial services, the importance of online marketing financial services presence and tips and tricks that can help financial service websites stand out and attract more clients.

Importance of a digital presence for financial service

- Build a social presence

Most people are on at least one social media platform and active in one of them; this means an untapped market online. Since money is a high-risk venture that needs building a relationship and trust, having an online presence works to your advantage. It helps you build a bridge between you and potential customers, providing them to learn more about your products without any pressure. Here is an example of a financial services social media page:

Financial services such as credit companies can use their online marketing financial services platforms to lend a helping hand and issue credit cards to individuals who shop online by giving them more information and running awareness campaigns. Social presence works by helping you become a brand and household name. The more people hear about you, the more they are likely to do business with you.

- Sell your products

A digital presence provides a platform for you to educate and pass valuable information on the various financial solutions you offer. It offers an opportunity to serve your clients and opens you to a broader market. For example, having a series that educates people about the importance of insurance and the various insurance products available in the market is a strategy to gain more insurance deals.

It also offers the public knowledge on what they stand to gain by having insurance. It therefore provides an opportunity for you to carry out quality marketing as clients understand more about the products you have without feeling like they are listening to a sales pitch.

iii. Establish your brand

Like any other service delivery, the financial sector gets hit with bad reviews, customer complaints and unsatisfied clients who need to rant. Most people, unfortunately, use their online spaces to voice their dissatisfaction, ask for clarification or more information. This behavior means that many of your clients say something about your brand online and other potential clients are reading them and perceiving your business from their reaction.

To protect your brand and build it as reliable and empathetic, ensure you have online marketing of financial service present with a dedicated team focused on answering your clients’ needs, offering clarifications and providing feedback to challenging issues clients face. For example, a financial institution can use its digital presence to keep customers updated on scheduled maintenance to avoid inconveniencing them. This act makes you look responsible and organized instead of clients experiencing unavailability of funds without prior notice.

Answering customers’ frustrations and meeting their needs sends a strong message to potential clients. People will only put their money where they feel it is safe; thus, trust plays a significant role in building financial institutions.

- Stay ahead of the competition

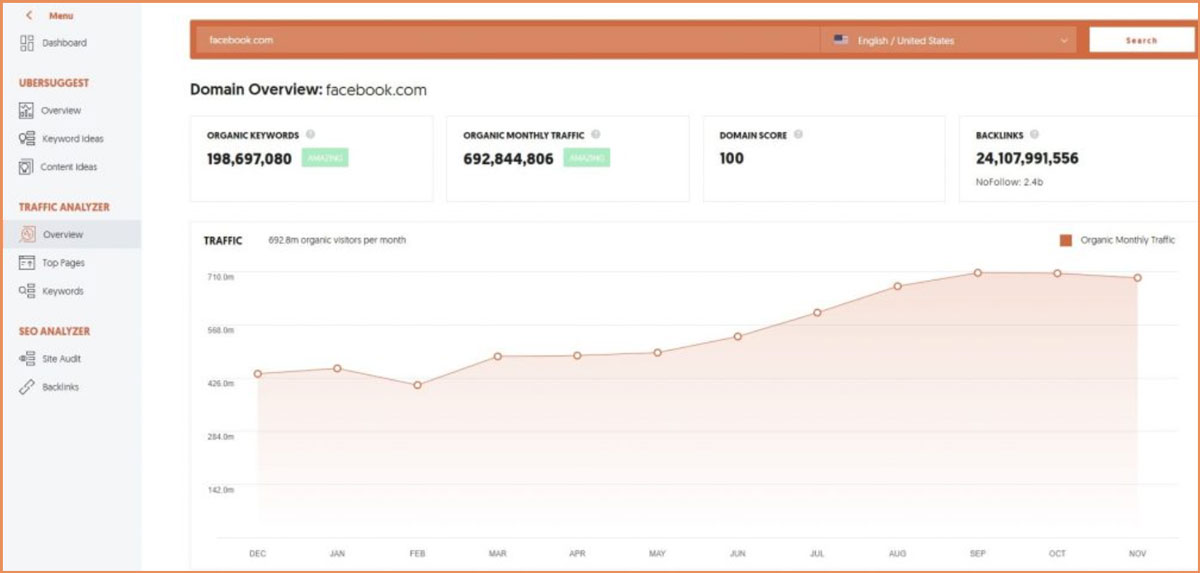

The financial sector boasts a wide range of private, government and non-governmental organizations that offer financial services; this means that the field is crawling with many financial institutions providing the same service. One strategy to stand out from the pack and become a household name is investing in your digital presence. Digital marketing for financial institutions helps you access many clients and build your brand, giving you an edge over your competitors. There are tools available to help you keep an eye on your competitors, for example:

By having content that resonates with your market, your clients will likely turn to you for financial assistance than your competitors who offer the same service. Remember, what people need as far as their money is concerned is to know that they are dealing with a trustworthy, reliable person who will not go bankrupt or disappear with their money. Thus, it is your job to assure them continually and one subtle way to achieve this is by having a unique online presence that surpasses that of your competitors.

Ways to Boost your digital marketing for financial service website

There are several ways to improve your digital marketing for financial success. Some of the best ways include the following:

Improve your content marketing + SEO in 60 seconds!

Diib uses the power of big data to help you quickly and easily increase your traffic and rankings. We’ll even let you know if you already deserve to rank higher for certain keywords.

- Easy-to-use automated SEO tool

- Get new content ideas and review existing content

- Checks for content localization

- SEO optimized content

- Built-in benchmarking and competitor analysis

- Over 500,000k global members

Used by over 500k companies and organizations:

Syncs with

You Might Also Like

Have a plan

It can sometimes be difficult for a financial institution to compete online and find their bearing to compete against digital influencers or funny online videos. However, having a plan ensures you develop diverse content that meets your audience’s needs. One key thing to remember is that your clients are online, and thus you should be too, since most people visit a financial institution less than fifty times a year but are online every day. Instead of focusing on the few minutes you physically have with this client, formulate a plan to ensure you have a conversation with them and keep them in the loop online.

Answering the question of what is online marketing of financial services entails explaining which ads to use, SEO optimization tools required, training for your digital team, and monitoring and acting on feedback. These plans help you formulate fun ways to reach your client and pass your information while maintaining interest. It also touches on converting more people into clients and the methods to ensure customers use your financial services internet marketing effectively. Thus, a plan is essential to ensure your website is regularly updated, customer needs are met and new clients are promptly served.

Work with experts

The reputation of a financial institution is a make or break deal. Working with professionals ensures your clients enjoy top-notch services and enables you to develop professional solutions that open more business doors for your institutions. Professionals in digital marketing for financial institutions are skilled in understanding online marketing of financial service challenges, outcomes and setbacks.

They can analyze a digital campaign and determine whether it brings positive results or is a liability to the business. This expertise ensures that the financial services digital marketing works to generate leads and business. Working with experts also ensures your work is appropriately executed, allowing you to capture your users’ attention.

Have fun and engaging content

As much as a financial service institution focuses on financial products, the content should be placed in a fun, easy-to-understand language to lighten it up and pass the message. It would help if you avoided having vocabulary or insider language that an ordinary person may not understand. You can devise ways of engaging your audience by frequently carrying out contests or providing financial literacy in a fun, straightforward manner. For example, you can have a fun video illustrating money laundering effects or online theft to help your customers be more careful with their bank details. Having varied content delivery techniques works to eliminate boredom and ensures your website is inviting.

FACT: 60% of marketers say that inbound (SEO, blog content, etc) is their highest quality source of leads. (HubSpot)

Learn from past performance

To have a digital marketing strategy that works and produces fruits is essential for one to learn from their previous performance. Analyzing your past performance helps you pinpoint which methods worked and which ones did not. This valuable information informs the type of steps and strategies enforced, helping you build an engaging and productive website.

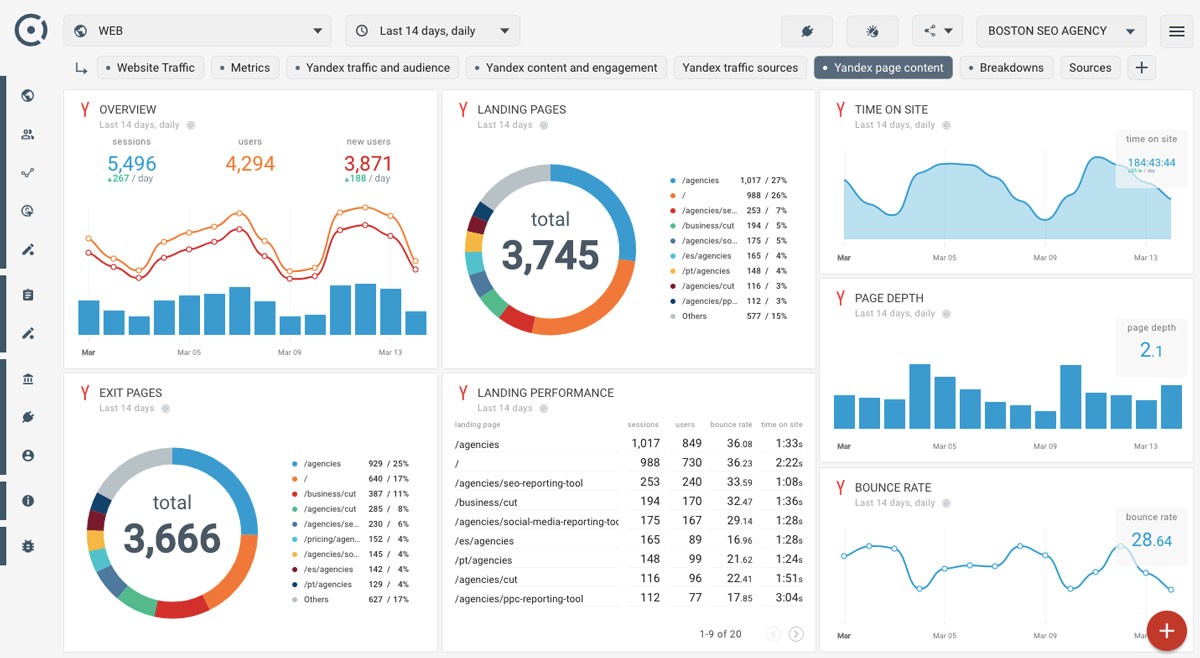

Your task is to ensure your digital system stays within budget and produces good results. Knowing what worked in the past helps in the budget estimation, picking which online tools to use and deciding on the different premiums charged by various agencies. It provides you with adequate information that helps you make a sound decision. The process ensures you learn from your mistakes by giving a detailed analysis of the target market that consumes your project and responds to your tactics. Some of the things you can learn from past performance include:

- How are people finding your page? – Do most of your visitors come from social media campaigns, organic searches, paid advertisements, or SEO optimization. Having this knowledge ensures you know what naturally works for you and which areas are more effective; that way, you know which areas to allocate more funds in your budget.

- Landing page performance – The landing page is the first place potential clients arrive when visiting your site. It is essential to know the implementation of this page to translate a person into a lead.

- Unique page view– A unique page view refers to the number of new people who visited your page. A unique page view is essential to know how many people exactly saw the page. A similar person may visit the page more than once, needing clarification or more details, so this data will be inaccurate if counted more than once. Such information enables you to correctly determine your conversion rates, giving you accurate data on your budget and expenditure.

(Image Credit: Octoboard)

Have a budget

Having a budget helps you carry out a successful online campaign and maintain a vibrant digital presence. Financial services websites need to do online marketing of financial services and set aside money to help them carry out digital marketing for financial services activities. Determining your budget is essential to help you plan and know what is at your disposal.

Setting aside money to help you buy high-quality images, form quality videos, or even record customer testimonials are some avenues an organization can use to make their content more relatable and convincing to their target market. A budget will also help you plan carefully and provide guidance on how much you can spend.

This process ensures you only place your effort on projects that are likely to bring positive returns and limit you from carrying out a campaign for too long. It will also ensure your company enjoys value as you can track your projects to see what returns they are bringing into the business.

Optimize mobile apps

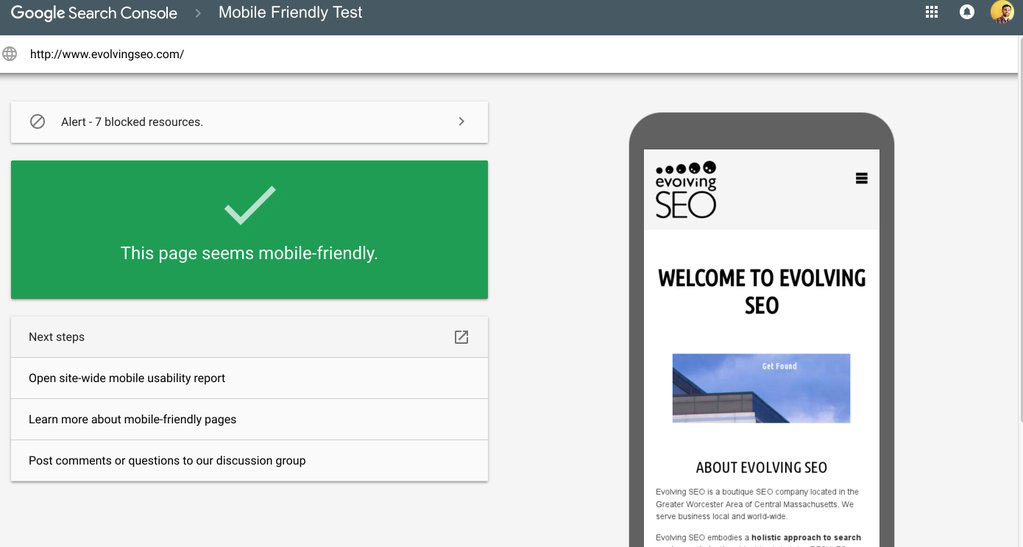

Mobile phones are the most used devices as most people spend more time on their mobile phones than they do on other devices. Thus, it is essential to ensure your digital marketing strategy is optimized to provide an excellent service for your clients using mobile users. One area to focus on is optimizing your installation and download to ensure your clients easily download your apps. Ensure your digital team works on having user-friendly and easy navigation interfaces on mobile to ensure customers don’t get frustrated when using your mobile app. Be sure to test your website with Google’s Mobile Friendly Test tool, for instance:

(Image Credit: Search Engine Roundtable)

Target genuine customers

The key to an excellent digital marketing strategy focuses on the quality of the customer other than quantity. Instead of having so many prospects realize what type of customer would benefit most from your service and focus on this client. Digital marketing tools allow you to describe the kind of customer you want and narrow your search to this type of person.

It enables you to provide the customer’s specifications and send targeted information to such individuals to increase your conversion rates. Thus, one way to boost your digital marketing outcome is to properly analyze who your audience is, whether it is a mortgage, savings account, loans, credit cards, or various services. Determining what you want is essential in getting positive feedback.

We hope that you found this article useful.

If you want to know more interesting about your site health, get personal recommendations and alerts, scan your website by Diib. It only takes 60 seconds.

Focus on each product individually

We know that financial institutions offer a variety of products. However, bombarding your viewer with all this product at once works against you. It is essential to ensure your website is well thought to avoid confusion and give the client an easy navigation time. It would help if you worked on ensuring each product has its page that provides details about your offer. Your website should contain more information on the various services you offer, then use your social media handles to drive traffic to the multiple pages. Thus, a financial institution can use its social media presence to post an ad weekly or daily that drives traffic towards a particular product. That way, you get to build a steady flow of content but ensure the client only focuses on one thing at a time to increase sales.

Deliver your services in a straightforward manner

The financial service website also acts as an extension of their office. Having proper service delivery means that customers can access your products online, and your website is adequately automated to provide accurate feedback. For example, you can use different digital marketing tools to help clients open accounts online or apply for credit cards in the comfort of their homes. Those looking for mortgage plans can get a mortgage calculator on your website to help them know their eligibility. These tools help you sell your products by packaging them as information; your website should also be easy to navigate and have necessary pop-ups to ensure your clients are not distracted.

Invest in SEO

SEO refers to search engine optimization and works to ensure your website and content are seen by the right audience. Having an optimized website ensures your content appears at the top of most searches helping you generate more traffic. One way of boosting your digital marketing is ensuring your content has quality backlinks and keywords that will enable it to score higher on Google and Bing searches.

You can utilize different digital marketing tools to help you track your SEO scores, learn from your competitors, and offer valuable solutions to help you score better and attract more people to your site. SEO also helps you learn from your competitors, and pinpoints what is working, helping you identify the loopholes in your area that need quick responses. It also allows you to know the different algorithms used by search engines to rank your website, helping you build a quality site.

FACT: SEO drives 1000%+ more traffic than organic social media. (HubSpot)

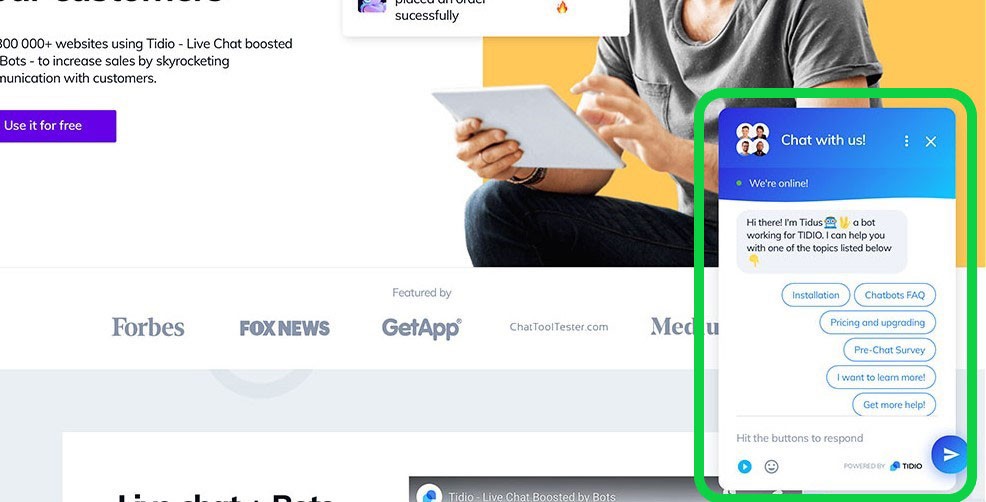

Have a standby customer service

Digital marketing helps you attract people to your site and ensures the right people to read your information. However, all this may be unfruitful if the people serving your customers once they access your product are not prompt. When formulating a digital marketing strategy, ensure you have a team working around the clock to meet your clients’ needs. You can also utilize digital avenues such as AI to ensure your clients are fully engaged and their questions answered. With new technology emerging, the use of AI is excellent for customer service. It provides the same benefits a person would but works round the clock, ensuring your service delivery is top-notch at all times. For example:

(Image Credit: Colorlib)

Diib®: Digital Marketing Stats at Your Fingertips!

Boosting your digital marketing for financial services websites is essential to build a robust online presence that is likely to help the business grow and maintain a brand. Diib Digital will give you metrics into the health of your digital marketing strategy; allowing you to change up your strategy for the utmost success. Here are some of the features of our dashboard that set us apart from the competition:

- Keyword, backlink, and indexing monitoring and tracking tools

- Google Core Algorithm monitoring

- PPC monitoring and tracking

- Alerts to broken pages where you have backlinks (404 checker)

- Alerts and Objective that guide you to strengthen your website

Click here for your free 60 second site analysis and industry ranking or call 800-303-3510 to speak with one of our Growth Experts.

FAQ’s

Digital Financial Services (DFS) include a broad range of financial services accessed and delivered through digital channels, including payments, credit, savings, remittances and insurance.

- Turn your website into a 24/7 sales representative.

- Get noticed by search engines.

- Invest in local SEO; claim your Google My Business Listing.

- Provide high quality, relevant content.

- Include video marketing campaigns.

- Stay active on social media.

- Increase leads with email marketing.

Examples of financial services are: checking accounts, car loans, personal loans, credit cards, savings accounts and investments.

There are many tools online that can help with digital marketing. Here are a few:

- WordPress

- Canva

- Ubersuggest

- Mailchimp

- Hootsuite

- Diib Digital

Financial services help improve economic conditions and lead to economic growth.