Låneportalen

Danmark

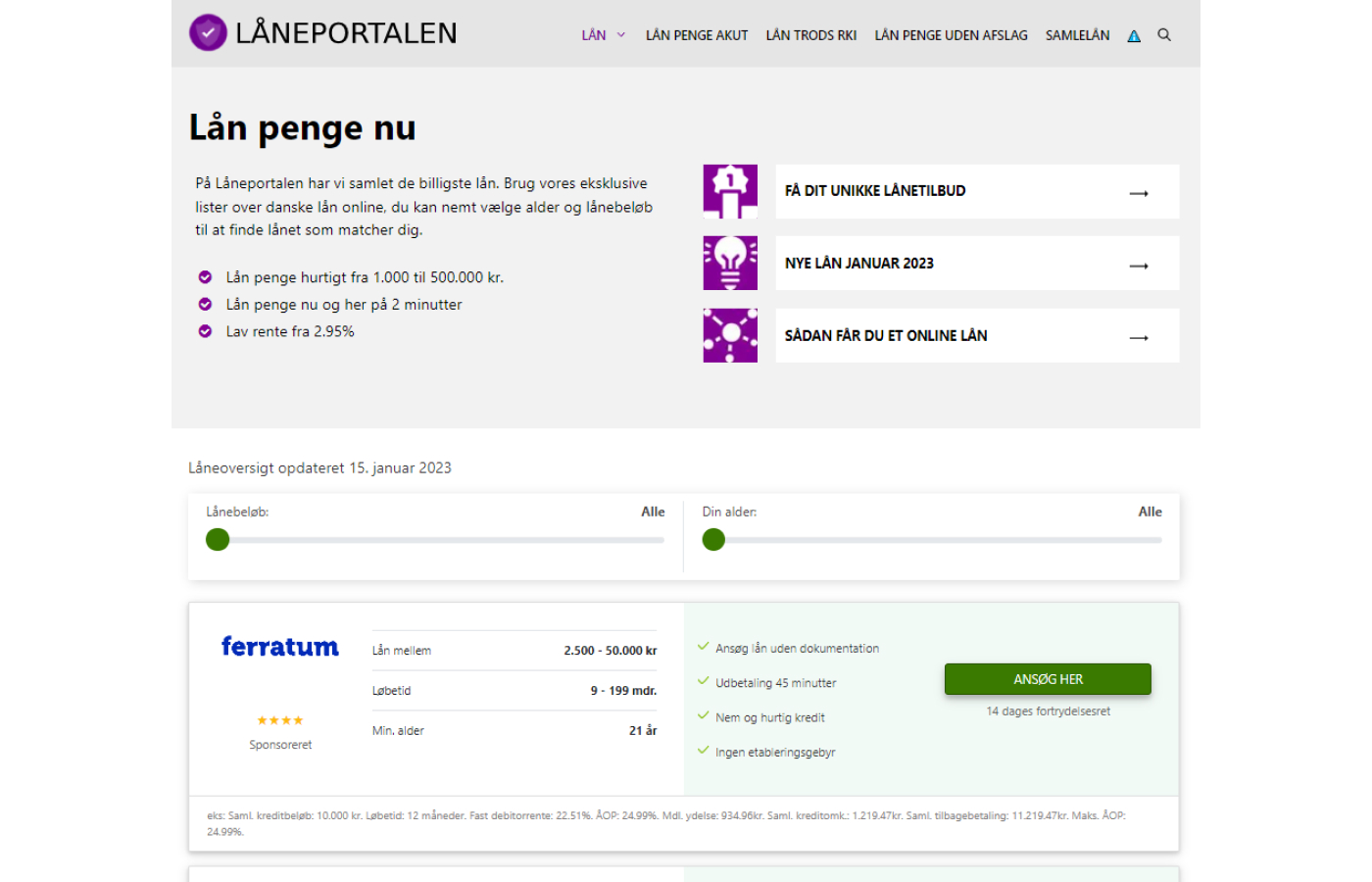

Lånepotalen is a comparison portal where you can quickly and easily compare products on the Danish loan market.

Main Services:

Forbrugslån , Kviklån , SMS lån , Samlelån , Kreditkort

We have collected the best loans in Denmark so you can quickly find the cheapest loans online. Use our exclusive lists of Danish loans online, you can easily choose age and loan amount to find the loan that matches you.

At Låneportalen we help you who want to borrow money to compare loans, interest rates and lenders under one roof. We help an average of 110 users a month get their loan approved. Comparing loans on Låneportalen to be able to borrow with a low interest rate is free for you as a consumer, and we only work with credit companies that are supervised by the Danish Financial Supervisory Authority.

You cannot borrow directly from us, but you apply for a loan from the loan provider that best suits your needs. A loan application is usually non-binding, and you always have a 14-day right of withdrawal during which you can cancel the loan. With an approved loan application, you have the opportunity to get money immediately.

Requirements and conditions for an approved loan

In order to get a loan, you must meet the requirements of the loan provider. The requirements can vary, depending on how much you want to borrow and what interest rate you are willing to pay, among other things. By law, you must be at least 18 years old to borrow from a credit company in Denmark.

Common terms and requirements are:

– That you can prove an annual income in Denmark, where the minimum amount is normally DKK 120,000.

– You must be at least 18 years old, although some lenders require you to be 20 years or older.

– That you have a Danish CPR number, MitID and permanent residence in Denmark.

– That you are not registered in the RKI, Debtor Register or other registers of bad payers.

– Some loans, such as mortgages, require a cash payment from you as the borrower.

– Secured loans require you to have some form of collateral, such as a car or a home.

However, you should be aware that a loan provider can decide what requirements they want met in addition to those laid down by law. It is important to always read the small print in the loan agreement when taking out a loan.