Building a reputation and a career as a professional financial advisor requires more than an accounting degree and the ability to deliver high-quality results. In order to succeed as a financial advisor, knowing how to effectively market yourself, your skills, and your abilities as a financial expert is a must.

Whether you are looking for ways to grow your current financial advisor company or if you are interested in scaling as an independent contractor, there are many ways to become actively involved with social media marketing for financial planners to significantly gain traction and attract new clientele.

Define and Get to Know Your Target Audience

Financial advisors and social media may not seem as if they would go hand-in-hand. However, with the right angle and an understanding of how to best reach an audience, just about anyone can launch successful campaigns with the use of social media today. As a financial advisor, it is first important to define and get to know your target audience and the clientele you want to reach and/or serve.

What Demographics Are You Targeting?

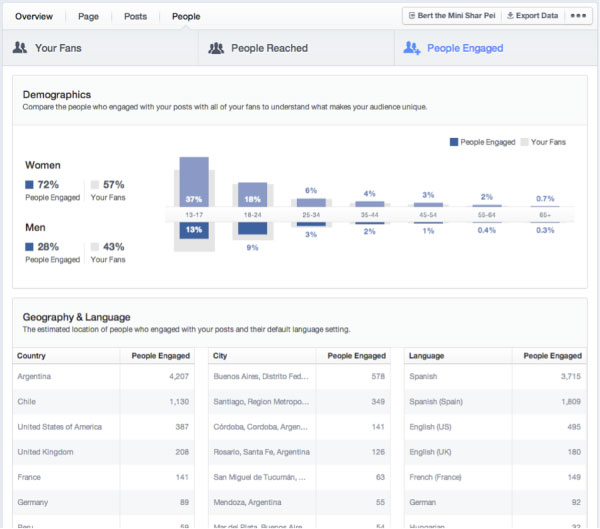

Before you begin promoting your content or the official website for your financial advisor services, it is important to determine what demographics you are targeting and trying to reach online. Consider the following when you are crafting digital campaigns and selecting keywords or targeted groups to appeal to:

- Age range: Are you targeting a specific age range with your financial advisor social media ad, or are you open to appeal to users of all ages, even those who may have little to no interest in financial advice?

- Gender: Do your financial advisor services appeal to mostly men, women, or both? Why might some of your financial advisor services be more suitable for men or women? How can you take advantage of these services to better appeal to specific segmented groups and audiences you have in mind?

- Location: What zip codes are you currently available and where are you providing your services? Are you willing to provide services virtually, thus, eliminating the need for location-based or geo-targeting with your online campaigns?

- Interests and hobbies: With the advent of social media, it has never been easier to create segmented audiences based on specific interests or hobby keywords. Hone in on the target audience you want to appeal to most by specifying keywords and hobbies or interests that are most likely to resonate with individuals who are seeking financial advisors and financial guidance.

You can track all of these demographics using social media analytics tools such as Facebook Page Insights, for instance:

What Problem Are You Solving?

Financial advisor social media campaigns should always strive to address and solve problems for readers and prospective clients. All social media posts for financial advisors should help provide valuable, useful, and unique financial information that is difficult or impossible to find elsewhere online, especially as you work to establish yourself as a trustworthy, reliable, and authoritative financial source within your industry and market.

Consider what problem(s) you are solving for your clients with your financial advisor social media ad and how you can better address the financial issues, struggles, or worries your target audience may have on their minds each day. Problem-solving and establishing an online reputation go well together, as they provide an incentive for users to learn more about a business or brand, even if they were previously unfamiliar with the provider or service.

Addressing Pain Points

Another way financial advisors and social media succeed is by successfully identifying and addressing pain points that prospective clients are likely to experience (or have experienced already). Successful financial planning social media campaigns will address specific pain points that may be holding future prospective clients back. Some pain points to address that may appeal to those who are in need of a financial advisor may include:

- Inability to save: A client’s inability to save and manage their savings properly may lead them to seek out the help of a financial advisor.

- Budgeting: If a client is struggling to manage and maintain a healthy financial budget, they may turn to a professional financial advisor to help them get the job done right.

- Loans: During tough times, individuals are more likely to require loans for personal and business purposes in order to remain financially afloat. If possible, you can hone in on loan pain points to help advise readers, subscribers, and prospective clients of all of their options when it comes to applying and being approved for loans.

- Debt: One of the biggest struggles facing millions of adults across the globe today includes mounting debt. Whether an individual is struggling with mounting college debt or credit card debt, you can use these pain points to appeal to those in your local area who may be in need of financial planning and advice.

Test your website’s SEO and social media score in 60 seconds!

Diib is one of the best SEO and social media monitoring tools in the world. Diib syncs to Facebook and Google Analytics and uses the power of big data to help you quickly and easily increase your social media traffic and SEO rankings.

- Easy-to-use automated social media + SEO tool

- Keyword and backlink monitoring + ideas

- Speed, security, + Core Vitals tracking

- Automated ideas to improve Social Media traffic + sales

- Over 500,000 global members

- Built-in benchmarking and competitor analysis

Used by over 500k companies and organizations:

Syncs with

Setting Up Campaign Goals

Once you know the audience you want to reach with your financial planning social media campaign, you can begin setting up campaign goals.

Setting Short and Long-Term Campaign Goals

Setting both short and long-term campaign goals can help you to remain focused on achieving them while also focused on your prospective clients every step of the way.

Consider which goals are most important to you based on the path you see for the future of your business as a financial planner or financial advisor. Some short and long-term goals to consider and keep in mind with your next financial advisor campaign online include:

- Attracting new clients

- Retaining current clientele

- Establishing your practice or services as credible, trustworthy, and authoritative

- Generating leads

- Driving traffic to your official website, blog, or social media presence

- Increasing engagement on blog posts and other content shared on your website as well as with the use of social media

- Increasing the number of newsletter and email subscribers you have

- Spreading the word of your business as well as of your services as a professional financial advisor in your area and local community

- Outperforming local competition and other financial advisors near you

- Boosting SEO, or search engine optimization within top search engine results

Define Measurables and Important Metrics

Once you know what campaign goals are most important to you, you can begin defining measurables and important metrics that are invaluable to each of your individual campaigns. Not all measurables and metrics will be the same with each campaign you create and launch, especially as your short and long-term goals continuously change and shift.

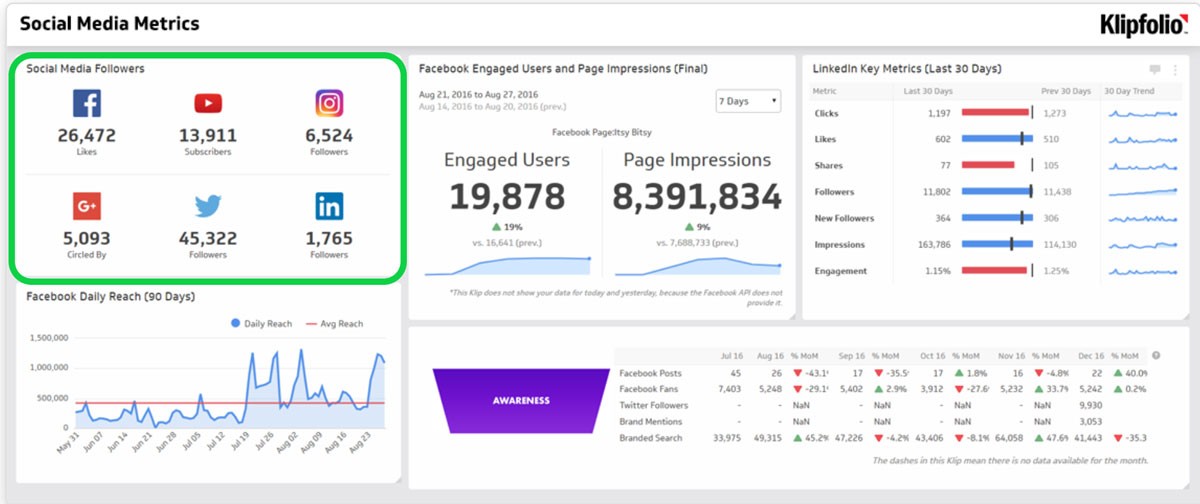

Followers

Tracking the number of followers you gain with the individual social media campaigns you launch as a financial advisor is extremely important and one of the most valuable measurables you can use within your digital marketing strategy. Gauging and comparing the number of followers you are able to gain and receive with each content update, sponsored post, or promoted ad can provide valuable insight into how to better communicate with your online audience of prospective followers and clients.

CTR (Click through Rate)

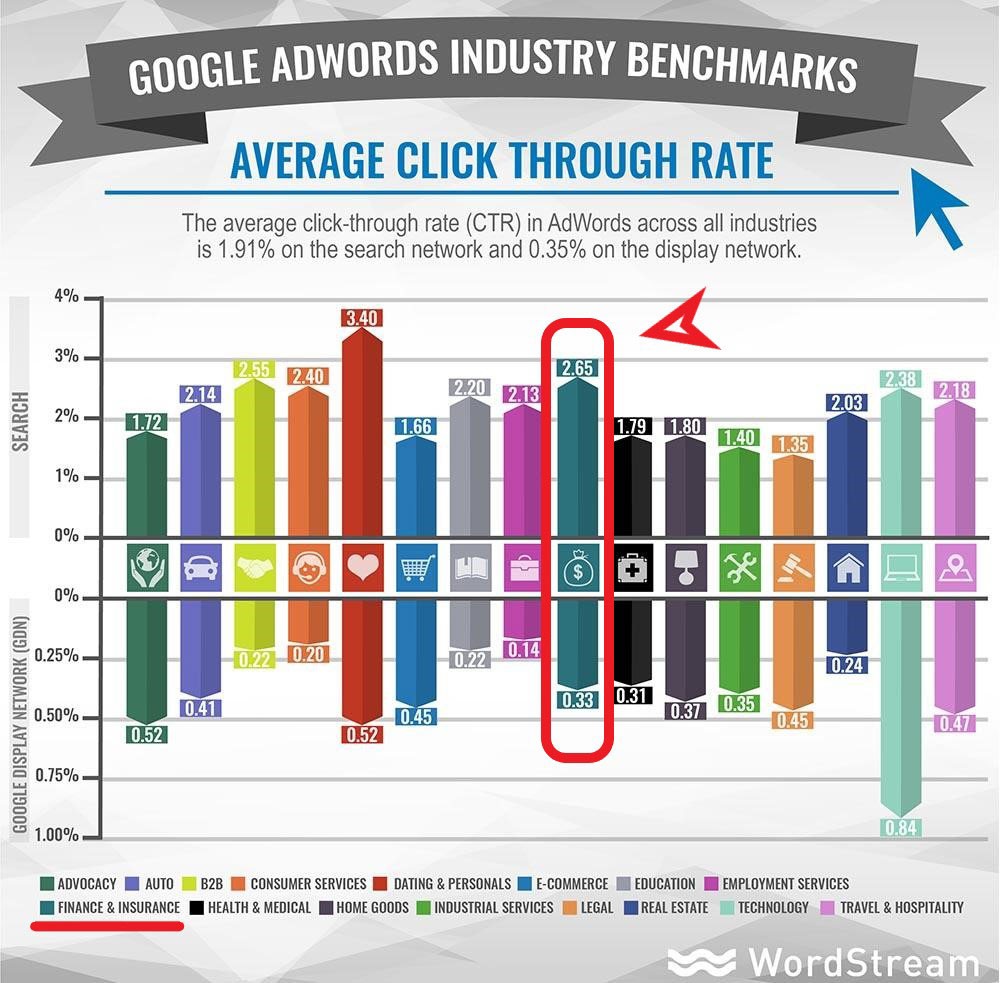

Consider tracking the CTR, or click through rate of each of your online campaigns as a financial advisor, especially when using tools such as Facebook Ads as well as Instagram Ads to launch your next ad. The clickthrough rate, or CTR of an ad, is the percentage of users who successfully clicked the link that you promoted and provided, allowing them direct access to the URL you utilized within the campaign itself. The higher a CTR is for a campaign, the more successfully it performed.

The overall CTR for a campaign may depend on how optimized your campaign is and how relevant your audience is as well as how well-crafted the copy and imagery are within the advertisement itself. The more relevant imagery and copy are to a user, the more likely they are to click on a link and visit a website to learn more. The image below shows the average clickthrough rate by industry including the financial industry:

You Might Also Like

(Image Credit: WordStream)

Leads

Tracking the leads you are able to generate is also another option as a financial advisor using social media marketing. Using social media marketing to track leads you generate can also provide you with valuable insight into the type of content, wording, and messaging that is working best to convey the sentiments and promotions you intend to share with your target audience.

Subscribers

You can also track the number of subscribers you receive for your newsletter or email list as well as on your website’s community or even other social platforms such as YouTube and Patreon. Choosing to track the subscribers you receive from individual campaigns is extremely beneficial for the optimization of future ad campaigns you intend to launch with the use of social media. For example:

(Image Credit: Klipfolio)

Customers and Purchases

Tracking successful purchases made as well as new customer registrations and sign-ups can also be done with the use of social media campaigns and selecting appropriate measurables and metrics to track. Keeping track of the number of customers or purchases you receive from each individual campaign and ad you launch is one of the best ways to discover marketing methods that are most likely to work in your favor.

Creating Your Financial Advisor Social Media Campaign Strategy

Creating your financial advisor’s social media campaign strategy does not have to be complicated or confusing with a better understanding of your audience as well as their own needs when it comes to maintaining their financial health and wellbeing. Before launching your next social media campaign, there are a few tips and tricks to keep in mind to ensure that you are on the right path and trajectory at all times.

Define Goals

Before launching your first social media campaign as a financial advisor, define and set goals you have for each individual advertisement you intend to use. Are you using social media to attract new followers, promote a specific service, or even establish yourself as a local professional within the financial sector? Knowing what you want to get out of each of your individual campaigns can help significantly when it comes time to choose keywords and specific target audiences to reach.

Set Your Budget

Be sure to set a marketing budget aside for your next social media marketing campaign. If possible, set a marketing spending budget for each day, week, and month you intend to promote your campaign. Using platforms such as Facebook Ads as well as Instagram Ads provides more customization options when it comes to setting your daily, weekly, and monthly advertising spending budgets.

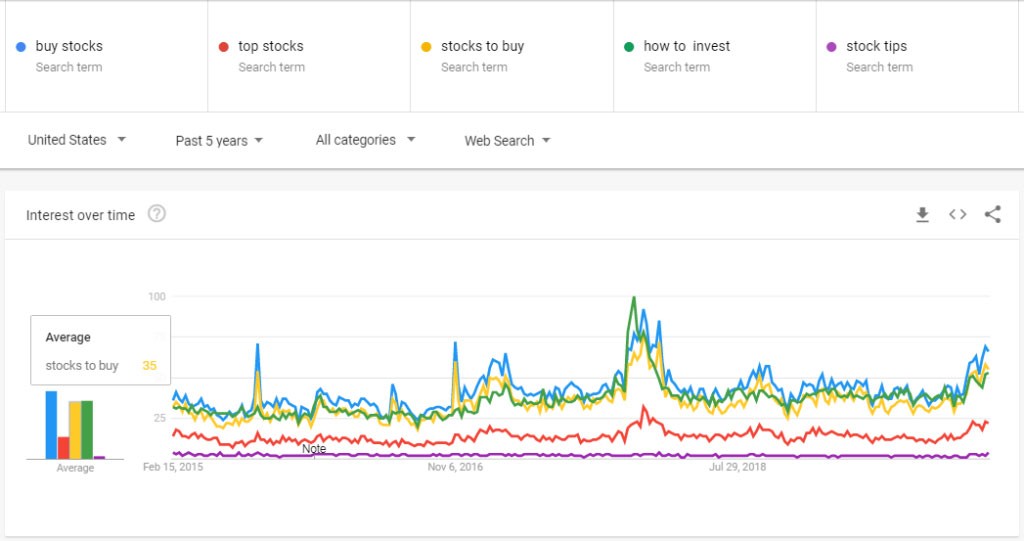

Use the Right Keywords

Choose keywords, phrases, and even specific trends to hone in on and target with your social media campaign. After using tools such as Google Trends as well as Google Adwords, gauge which keywords are best to target based on the demographics you are trying to reach and the type of clientele you want to attract. For instance:

(Image Credit: Trading Strategy Guides)

Selecting keywords and target phrases greatly depend on the type of campaign you are running as well as specifics of the campaign and its timing. If you are promoting deals and discounts or specials due to holidays and the time of year, be sure to factor in these elements when selecting and researching keywords to use within the campaign itself.

Adding Visual Elements

Visual elements can make or break a marketing campaign, regardless of the market or niche you are in and representing. Without visual elements, catching the eyes of prospective clients can quickly become daunting. Adding the right visual elements to a social media campaign can mean the difference between succeeding and falling short of your intended expectations.

Use high-quality logos, photography, and other graphics to help highlight and promote your financial advisor services. Consider the impression you want to leave with online visitors and prospective clients when selecting the graphic and visual elements that are optimal for you. If you are feeling less than creatively inspired, visit the websites and pages of competing financial advisors in your area to learn more about their visual appeal and the aesthetic they chose to integrate with their own business model and online branding.

We hope that you found this article useful.

If you want to know more interesting about your site health, get personal recommendations and alerts, scan your website by Diib. It only takes 60 seconds.

A/B Testing

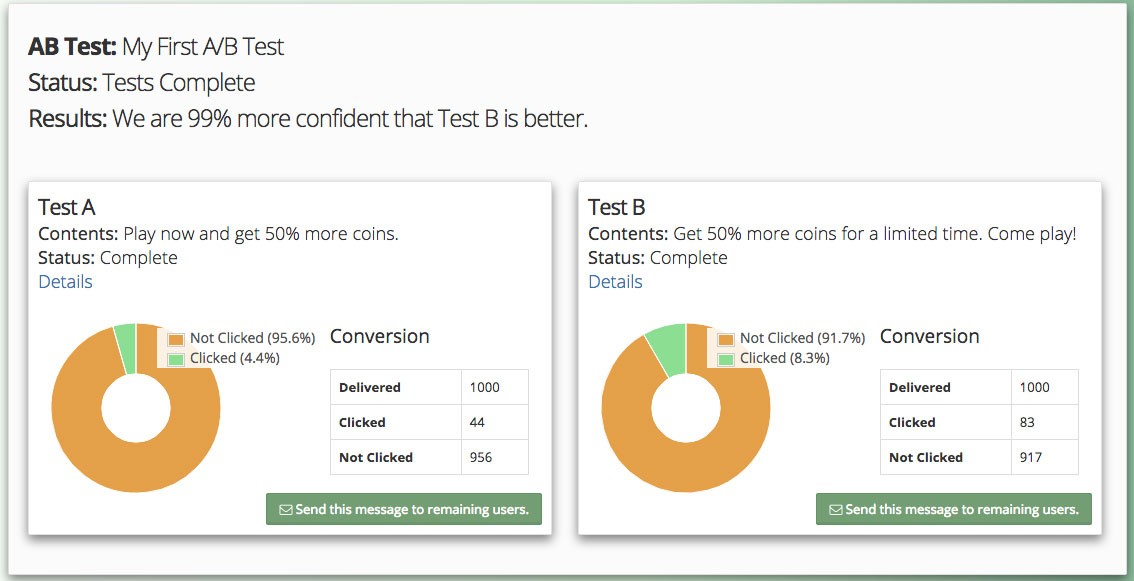

A/B testing is a must for anyone who has launched a social media campaign online. With A/B testing, learn more about which ads work based on headlines, keywords, and even visual elements used within individual campaigns themselves. Marketers typically use A/B testing to determine which type of imagery or look and feel works best to appeal to specific demographics and segmented audiences to provide optimal outcomes and results. Here is an example of an A/B test:

(Image Credit: OneSignal)

Tracking the Success of Your Social Media Marketing for Financial Advisors

Tracking the success (or failure) of your social media marketing campaigns as a financial advisor is essential in order to prevent overspending and wasting time on broad and under-optimized campaigns. Using the proper tracking tools, learn how to keep an eye on all of your social media campaigns and how they are performing in real-time.

Use Facebook Ads or Instagram Ads

Two of the most complex and robust ad campaign trackers and systems designed specifically for use with social media include both Facebook Ads as well as Instagram Ads. Using Facebook Ads and Instagram Ads provides in-depth stats, analytics, and data for individual campaigns you launch and have running live across both platforms. Use Facebook Ads or Instagram Ads to monitor the overall effectiveness of each campaign you launch live using the platforms within an instant.

Using Google Analytics

One way to track the success of lead generation and driving traffic to your website from social media directly is with the use of Google Analytics. Using a free solution such as Google Analytics is one of the quickest ways to gauge the overall success of individual campaigns for any financial advisor service or package you are promoting. For example:

(Image Credit: Neil Patel)

Use Google Analytics to track any and all traffic that is driven back to your website from various social media platforms including Facebook, Instagram, Snapchat, Pinterest, and even Twitter or LinkedIn, depending on the type of clients you want to reach. With Google Analytics, learn more about what type of campaign is driving the most traffic and clicks to your website and why. Spend time gauging which words, headlines, and CTA solutions are most likely resonating with the audience you are trying to reach.

Diib®: Custom Analytics for Your Social Media Campaigns!

Social media marketing for financial planners does not have to seem difficult, stressful, or confusing once you have familiarized yourself with the world of online marketing and campaigning. With a deeper understanding of your target clientele and a better understanding of social media posts for financial advisors that work, the opportunities become virtually endless as you dive in and explore the world of social media marketing.

Partnering with Diib Digital can give you the added confidence of analytics and demographics for your campaigns. This will allow you to fine tune your strategy for the utmost success. Here are some of the features of our User Dashboard that set us apart from the crowd:

- Social media integration and performance

- Platform specific audience demographics

- Keyword, backlink, and indexing monitoring and tracking tools

- User experience and mobile speed optimization

- Technical SEO monitoring

Call today at 800-303-3510 to speak with one of our Professional Growth Experts or click here for your free 60 second site scan.

FAQ’s

The first advice we have is to be authentic. Know your clients and provide information that would be beneficial while also showing them you’re approachable. Start slow, don’t bombard them with information. 1-3 posts a week to start with is ideal.

Here are our top 5 strategies for financial advisors to market themselves.

- Host an event for clients, potential clients or just the public.

- Start a blog with quality information and a place where people can ask questions.

- Stay active on social media.

- Join small business think tanks.

- Network with other local businesses.

Historically, these firms haven’t spent much on marketing. The typical firm spends no more than 2% of its revenues on marketing.

- Best Overall: Salesforce.

- Best User Experience: Redtail Technology.

- Best CRM for Small Firms and Independent Advisors: Wealthbox.

- Best Industry Integrations: Junxure.

- Best End-Client Experience: Envestnet Tamarac.

- Best Value for Small, Growing Firms: UGRU Financial.

First of all, create a website that contains valuable information. 2) Create a high quality blog. 3) Build an email list. 4) Run online and social media ads. 5) Claim your Google My Business Listing.